I’m coming at you a little late this month for the market roundup, but it made sense to give Tales of Aria a little time to breathe before assessing where it’s at.

I’m also making one larger change to the series this month that I expect to maintain going forward. The market on older sealed product and singles has largely settled down, and we aren’t seeing wild month-to-month swings anymore. For instance, WTR sealed has ticked up a bit since last month, but it’s nowhere near as profound as the sort of shifts we were seeing six months ago. So I’ll only be giving short notes on these products unless something notable happens, as opposed to devoting a whole chunk of the article to them each month. This will free up space to talk about more active market segments and some areas that I previously didn’t have time to discuss.

Beyond the lack of movement, these products are also simply not accessible to the vast majority of people participating in the market. Simply put, whether a sealed alpha box is $3800 or $4500 is immaterial to most people engaged with Flesh and Blood because they can’t and/or won’t spend that kind of money on cardboard. Moreover, the people who can and/or will are more likely to already have a firm grasp of the market, so they’re less likely to benefit from these discussions anyway.

Tales of Aria

Of course, the topic of the month is the Tales of Aria release and the market reaction, and that’s where we’ll be spending the bulk of our discussion.

I feel somewhat vindicated to see that the $175 preorder prices did not bear out and we’ve instead landed at around $120 as the sealed box valuation. We’ll likely see some movement up and down over the next month- I would guess something around plus or minus $10-20 with a couple weird outliers on either side. The immediate take home for everyone should be that the print run is notably larger than Monarch’s. While we still don’t know how big Monarch was, Tales was clearly larger- given the fact that, post-launch, boxes remain readily available from major retailers (most of whom are still trying to squeeze out prices in the $135-150 range).

I still feel quite good about sealed Tales as a long term prospect on the scale of a few years. It’s not currently being overhyped, and prices have a lot of room to grow. As long as the game is still alive and well, I don’t see any reasonable way for prices to drop significantly, so the risk of holding is also relatively low. For people who are looking to get into sealed box/case investing but haven’t yet, Tales is going to be an excellent entry point, particularly since boxes are low enough that we should expect a modest bump once the supply does start to dry up.

The Tree and the Library

While boxes are looking promising, my feelings on the cold foil market is a little more cautious. As expected, the rarest cards in the set shed a lot of value between their Vegas preview and a week out from release. This is normal and no cause for concern. The question to ask right now is whether the current prices represent where the market will settle or if they’re still in the falling prices period. I tend to lean towards the latter.

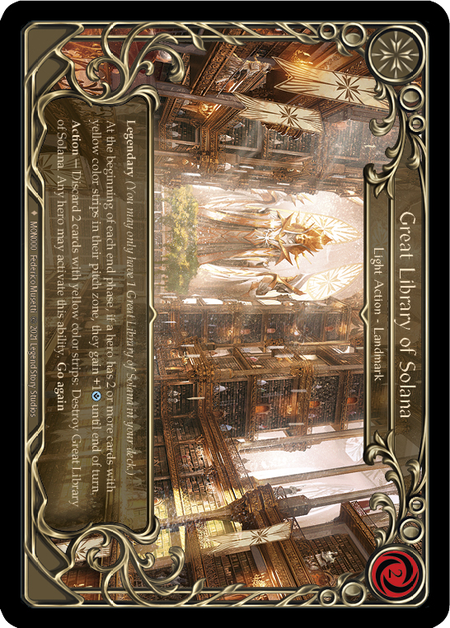

As ever, my point of comparison is looking at where similar cards are in previous sets and asking, “does this make sense?” For the Fable slot, we currently see Korshem selling around $500-550. By contrast, cold foil Great Library has been selling for between $900-1300. Great Library made an appearance in the deck that won the Las Vegas Calling, which has led to a small uptick in the price of the cold foil and rainbow foil versions of the card, halting its gentle downward motion prior to the event. Korshem, by contrast, has yet to prove that it is playable. I’m inclined to believe that we’ll see its price trickle down a bit from the current valuation as more product is opened, unless it makes a strong case for itself as a competitive role player. It’s unlikely to crash totally, given that there is still enthusiasm for CF Fables in the abstract, but I can definitely see a future where they’re a lot closer to $400 than $500.

Legendaries

Legendaries are a bit of a different, albeit interesting, story. In the short time since the set’s release, we’ve already seen downward movement followed by a rebound across the board. Every Legendary except Spellbound Creepers has moved up about $40 from its low point, and Creepers are up $20. This translates as a high of $290-300 for Rampart of the Ram's Head (the most valuable L at present) to a low of $160 in Creepers.

I think these prices are likely high for all Legendaries. For contrast, let’s look at the CF Monarch Legendaries, which have had ample time to settle into their values. Phantasmal Footsteps is the highest valued one at $330-350, Carrion Husk follows up at $300, Dynamo and Vestige have recently sold at $160 and $200 respectively, and Eclipse and Doomsday are at about $90-100.

I don’t like the look of that comparison. To me, it means that either Monarch cold foil Legendaries are priced too low or Tales of Aria cold foil Legendaries are priced too high. As I discussed, all indications are that Monarch has a smaller print run than Tales.

We also have the market’s partial rejection of Eclipse and Doomsday as collectibles. Eclipse was pervasive in pre-ban Chane decks, yet its play usage was unable to overcome the fact that you shuffle it into your deck instead of starting the game with it in play. A lot could be said about whether this position is correct or incorrect (I tend to think it was incorrect), but the end result is that Legendary value in Monarch is consolidated in Husk and Footsteps. Take that, combine it with the larger TOA print run, and something has to give. Either that means that Footsteps and Husk prices pick up, or we see Tales Legendaries fall off.

The complicating factor, of course, is that Tales of Aria unlimited is still some months out, so anyone who wants to use the cards needs to buy cold foil copies to play in the interim. This may temporarily push prices up, but as we saw with Crucible of War, once unlimited does drop, prices of the first printing will take a dive if they were partially based on players needing copies for their decks as opposed to collectors and investors picking them up for their binders.

In short, current TOA L prices make me nervous even if they hold for the next few months because I think there is a strong chance that you can get caught holding the bag when rainbow foil copies become available. I wouldn’t buy Tales cold foil Legendaries in the next few weeks unless prices either come down or you need a specific one for play.

I wouldn’t buy Tales cold foil Legendaries in the next few weeks unless prices either come down or you need a specific one for play.

Other Valuable Cards

The other chase cards for Tales consist of the alternate art rainbow foil Channel Lake Frigid, and the Majestic and Common cold foils.

Channel Lake Frigid’s most obvious comparisons are the extended art Majestic variants from Monarch. Those have had very few recent sales on TCGPlayer and ebay. However, like most cards from Monarch, all three have dropped dramatically from launch, resting at around $150-200 apiece.

Given that, Channel Lake Frigid’s current $200 price tag seems high. If it’s very widely played in a top deck, I suppose it could hold on, but it’s more likely that we see it fall a bit to put some space between it and extended art Herald of Erudition (the top Monarch extended art Majestic). While we can’t be 100% certain that the distribution of these variants is 1:1 across sets, the higher print run argument makes me want to exercise significant caution regarding Channel Lake Frigid.

The CF Majestic Pulses are all selling for about $60-70, which represents a slight uptick over the last week. These prices seem OK, though again, they’re only a little below current Eclipse and Doomsday prices. I would expect separation on these based on which ones see the most play. Downward movement to $40-50 on some or all of them wouldn’t shock me either.

Cold foil Majestic weapons are doing a bit better, with Winter’s Wail and Voltaire, Strike Twice sitting at $100 (again, representing an uptick over the past week). Duskblade, which would have been the premier CF Majestic were it not preemptively banned in Classic Constructed, is dragging behind at $50.

Again, usage will likely dictate the relative prices of these, but one thing to keep in mind is that the Monarch Majestics commanded very high prices for quite a while (especially relative to the Monarch Legendaries), but that has increasingly been less and less of the case. Lumimaris has held out in the $300-375 range, but the rest have fallen in recent weeks, most notably the alternate art Galaxxi Black, which has had a few recent ebay sales under $400. For a card that is not heavily played and mainly draws its value from being an interesting curio, I would expect it to eventually fall below Luminaris, which remains a staple in a popular and competitively viable hero’s deck. Other CF Monarch Majestics are already down to the $80-130 range, which again suggests that we could and probably will see their Tales of Aria counterparts cede some more ground over the coming weeks.

Cold foil commons are all currently sitting at between $15-20. These will likely also separate a bit as we see if any of them take off in constructed play. I’d anticipate short term motion in both directions. Any sought-after pieces could pick up $5-10 in value in the short term, and the ones that no one uses could easily shed $5 or more. There is probably a floor on cold foil commons still because there are enough people who want to collect them and any cold foil is a limited printing, but I wouldn’t be buying up stacks of Rotten Old Buckler any time soon if I were you.

Non-Foils and Rainbow Foils

Despite the unlimited Tales of Aria printing being a ways off, first edition product is plentiful enough that all non-foil Majestics have remained relatively cheap, with the current ceiling around $10 or less and Pulse of Volthaven as an outlier at $15. The general lack of interest the FAB community has displayed for non-variant rainbow foils continues, with only minor premiums being paid on the shiny versions of these cards. There is short term potential for the most widely played Majestics to go up in price if adequate play demand emerges for any of them prior to unlimited (the lack of true generics in this set means that individual new heroes really need to do serious work to drive demand). However, we should all anticipate that the unlimited edition of Tales of Aria will bring with it a less severe version of what we saw with Monarch and Crucible: price drops across the board for non-foil and rainbow foil first editions of pretty much everything.

This is speculation on my part, but I do expect the Tales of Aria unlimited release to be more tightly controlled than Monarch was. The fact that LSS is releasing it several months later and that the first print run is, by all appearances, meaningfully larger than Monarch’s means that they probably anticipate adequate supply to avoid runaway prices on staple Majestics. The volume of unlimited that will be hitting the market will probably be more restrained like Crucible unlimited. This will be done to avoid the Monarch situation where big retailers were using every trick they could to dump unlimited boxes at prices that were, at times, below what smaller retailers were paying wholesale. Because of this, Tales unlimited’s negative impact on first edition singles prices will hopefully be less dramatic than Monarch’s.

Playmats

I wrote about what I see as the probable decline in the high average price of Flesh and Blood playmats as my September mid-month article, and we’ve got an interesting data point to add to that position. Several of the major retailers were given unique limited playmats to sell with their Tales preorders. The pricing of the bundles that these mats were initially offered in valued them at close to $100 a piece or more. This isn’t without historical precedent, but now that the set is out and stores are still sitting on sealed product, we’ve seen Star City Games cut the price of their mat bundle (one case of TOA and a mat) to just $25 over the cost of a sealed case with no mat. That tells you pretty concretely where they’re valuing the playmat, and I expect that sort of sentiment to continue to bleed into the market.

Extremely limited mats will likely fetch a premium for the life of the game, but we’re talking mats with total runs of 100 or less. These 1000+ run mats are becoming too common, and the amount of people who are collecting every mat is a tiny, tiny portion of the FAB community. For the most part, people want between one and a small handful of mats, and once they have them, they may go a year or more without acquiring a single new one, all while the total number of different mats being put into the market continues to rise. Be cautious with playmats as we move forward, especially if you’re picking them up in bundles with the intention of flipping them.

Viva Las Vegas!

The Las Vegas Calling was a big success in terms of attendance numbers and has potentially contributed to the recent market stability and uptick. The fact that we didn’t see a big spike in high end collectible cards suggests that we’re closing in on appropriate valuations for older products. WTR alpha boxes have climbed back to $4500-5000 from the lows of $3000-3800, and there have also been some recent $2000+ WTR/ARC CF Legendary sales that suggest a recovery there as well. These are all good signs of the long term health of the market.

However we definitely haven’t achieved a jump back to peak prices, and I wouldn’t expect to see one at this point. I think we’ll get there again, but it’ll likely be over a series of smaller jumps as opposed to a single event galvanizing the market back to its high point. Still, the success of Vegas remains a strong indicator of the game’s increasingly robust player base.

A Word on Print Runs

Throughout this article and in many of my past ones, I’ve talked about the relative sizes of print runs and how I expect them to impact the prices of singles and sealed product. I want to note that I think we’re fast approaching the period in time where an increase in print run from set to set is going to matter a lot less than it has thus far. I believe there is a point where the print size of sets will be sufficiently large such that, even if two sets differ moderately from one another, we’ll see little impact on overall pricing of the two sets for the first few years following their release. If LSS continues on the current path, at some point we’re going to see a FAB set release where first edition boxes will sit on shelves at MSRP for at least a few weeks or months (this is a good thing in my book).

Once that happens, we’re going to finally establish what the rough range is for cold foils and variant rainbow foils at each rarity. In-print Legendaries might range from $50-150, for example. Variations will obviously exist within each category- a Fable that sees competitive play in top decks, like Great Library, will be worth more than one that mostly sits in people’s binders. However, we’ll probably see the end of the diminishing returns on each set where the expectation is that all categories of cards with be worth less than their analogs in the preceding set.

I’ll likely turn back to this topic as the next set launch approaches, but it is definitely something to keep in mind once pre-orders start opening up. Be cautious and remember that Tales of Aria at $120 should be the absolute ceiling on what you pre-order the next set at, unless you have a compelling reason to believe that LSS is printing less of it than Tales.

Until next time!